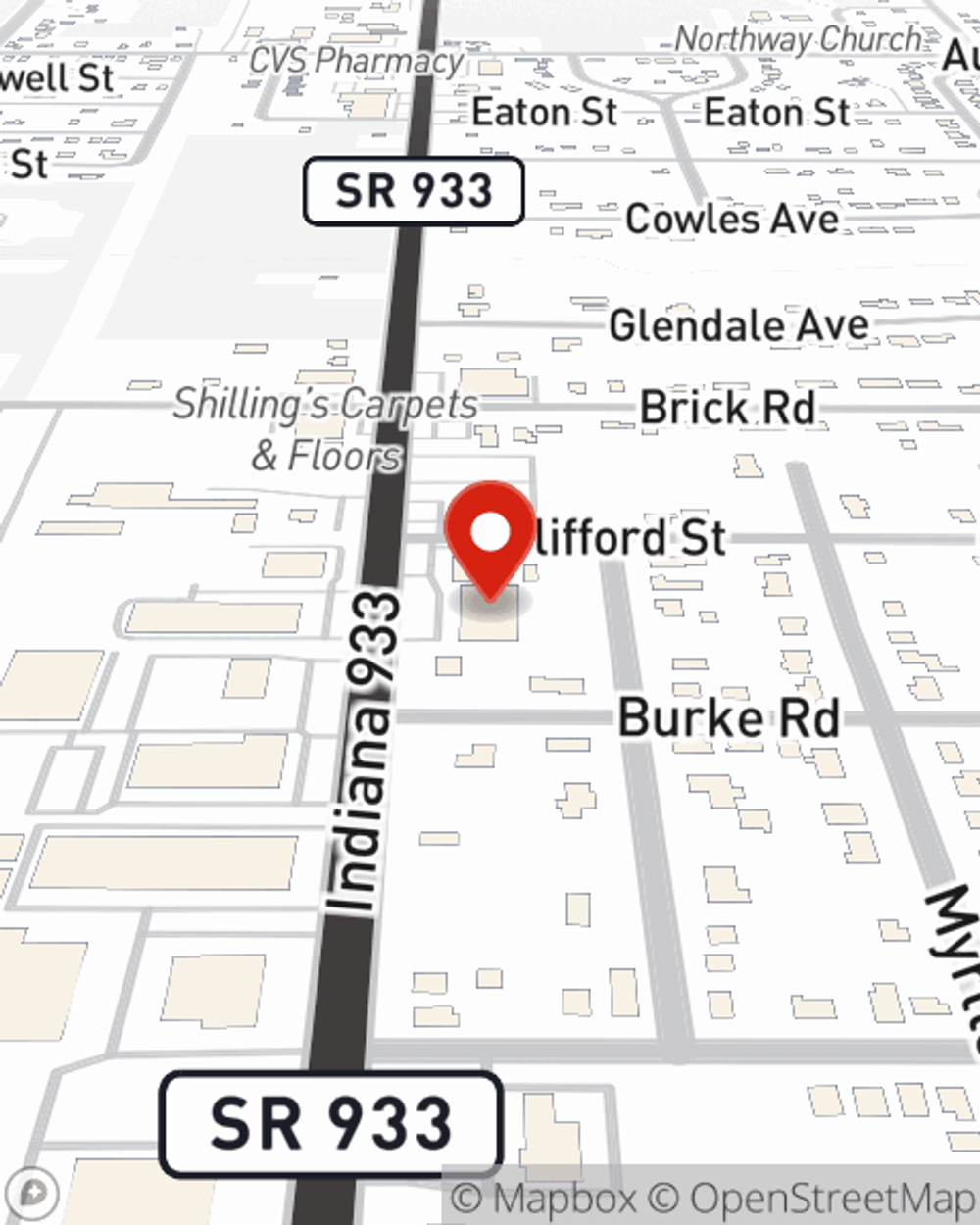

Business Insurance in and around South Bend

Looking for small business insurance coverage?

Helping insure small businesses since 1935

- South Bend

- Mishawaka

- Granger

- Notre Dame

- Roseland

- Osceola

- New Carlisle

- Elkhart

- Walkerton

- North Liberty

- Niles

- Bremen

- Laporte

- Michigan City

- Middlebury

- Plymouth

- Wakarusa

- Culver

- Michiana

- St. Joseph County

- Marshall County

- Elkhart County

- Cass County

- Berrien County

Help Prepare Your Business For The Unexpected.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide terrific insurance for your business. Your policy can include options such as errors and omissions liability, business continuity plans, and extra liability coverage.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Donovan Hawkes for a policy that safeguards your business. Your coverage can include everything from errors and omissions liability or worker's compensation for your employees to commercial auto insurance or professional liability insurance.

Contact agent Donovan Hawkes to consider your small business coverage options today.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Donovan Hawkes

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.